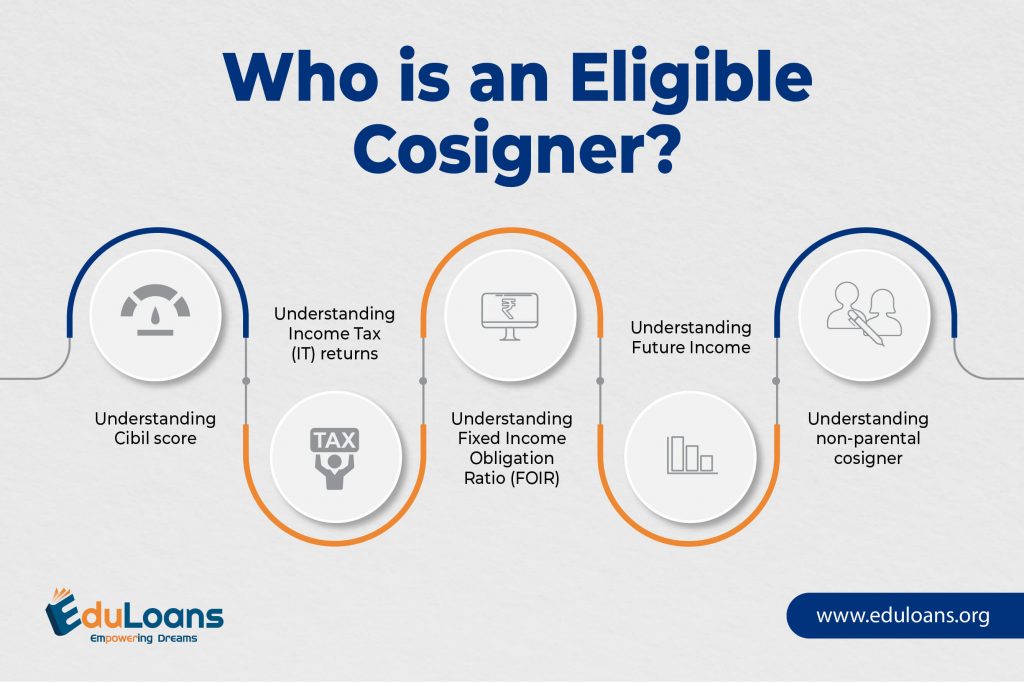

derstanding Cibil score – Cibil is a body which provides the credit score of any Indian individual. The score ranges from 300 to 800. Majority of the financial institutions want a credit rating of above 650. In case the parent has never taken a loan, he will not be eligible if his credit score will not be above 650. It is recommended that a track record be built for a parent to successfully get an education loan for study abroad. In case the parent has defaulted even as small as a credit card, Cibil score will be affected. Hence, the parents are advised to clear all loans and EMIs that can create a bottleneck for securing an education loan abroad for your child. Unsecured lenders are more particular than secured lenders with regard to the Cibil score of the parent.

Understanding Income Tax (IT) returns –Most of the financial institutions providing education loans abroad compulsorily want to see the IT return for at least the last two years if not three years. Parents need to file IT returns in case they wish to cosign alone for study abroad. The minimum IT return is approximately around 4 to 5 lakhs for an unsecured or a secured loan.

Understanding Fixed Income Obligation Ratio (FOIR) – Fixed income obligation ratio (FOIR) is the amount of accrued EMI to the free income available by the parent/cosigner. Once they have understood the IT returns of the parent, the financial institutions especially NBFCs look at EMI’s or other financial obligations of the parents/cosigner. They reduce this amount from the net income of the parent/cosigner. In majority cases, the FOIR cannot be more than 50/60%. This means that the maximum EMI possible is 50% of the free cash flow of the cosigner.

Understanding Net Worth – In cases of loan for study abroad where the parent is on the verge of retirement or has passive income, certain financial institutions especially secured ones look at the net worth of the family. The net worth is an assurance that the parents are capable of repaying the loan in case the student defaults on the payment.

Understanding Future Income – In cases where the student is looking at an unsecured education loan abroad, most lenders look at the future earnings of the parent. In case the parents are going to be retired, a student shall not be provided an unsecured loan by many lenders for study abroad. In this scenario, the loan for study abroad usually comes with the mortgage of collateral security.

[“source=eduloans”]