Thousands of teachers, social workers, first responders, nurses, doctors and other government and nonprofit workers could have their federal student debt forgiven starting in October.

But the road to debt forgiveness is not a cakewalk. Many of these borrowers have complained to the Consumer Financial Protection Bureau that their loan servicers have given them incorrect information about public-service loan forgiveness and made errors with their loans that disqualify them for the program.

Here’s how the public-service loan forgiveness works: If you take out a federal student loan, you have your loans forgiven after making 10 years of on-time payments and by working for an employer the Department of Education deems to be serving the public good. Qualified employers include local, state and federal government agencies and nonprofit organizations. (Private lenders don’t offer this option.)

Since 2012, borrowers could certify with the Education Department that their employment would qualify them for public-service loan forgiveness. The number of borrowers who have been approved has grown rapidly, to 552,931 as of the end of last year. (See chart below.)

Nearly two-thirds of borrowers who have certified interest in public service loan forgiveness make less than $50,000 per year, according to the CFPB.

Some qualified borrowers will be able to use this benefit starting this year because public-service loan forgiveness was created in 2007.

The Government Accountability Office estimates 25 percent of U.S. workers are employed in jobs that could qualify them for public-service loan forgiveness if they have student loans and know about the program.

More from College Game Plan:

This student debt strategy can save you more than $18,600

Three ways to avoid the financial death spiral of defaulting on your student loans

The 3-minute tool to calculate your actual college costs

Some critics of public-service loan forgiveness argue that the program redirects limited federal aid from college students of low-income families who need it the most to people with graduate degrees who can afford to pay off their loans.

“Public-service loan forgiveness is a program that mainly benefits grad students,” Jason Delisle, a resident fellow at the conservative think tank American Enterprise Institute, told CNBC in May.

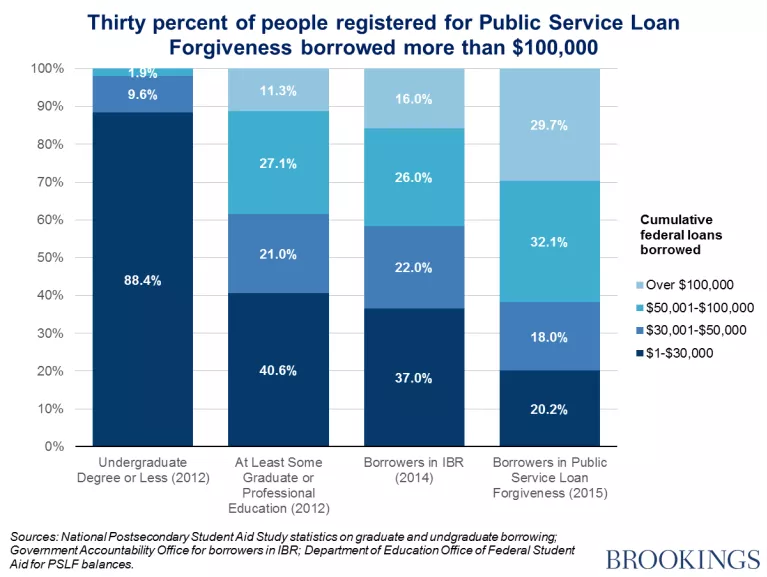

The median debt load of those enrolled in public-service loan forgiveness is more than $60,000, and nearly 30 percent of people who have been certified for the program have borrowed more than $100,000, according to a 2016 analysis Delisle undertook for the Brookings Institution (see chart below).

One problem with controlling the costs of public-service loan forgiveness is that the Department of Education has an open-ended definition of what public service is, Delisle said. He sees public service as a redundant benefit because federal student loans already offer loan forgiveness under income-based repayment plans.

Public-service loan forgiveness is tax-free to borrowers and only takes 10 years. Borrowers who have their loan forgiven through income-based repayment plans have to wait for up to 25 years.

Student loan forgiveness through income-based repayment plans doesn’t let borrowers completely off the hook either. Debt canceled by student-loan repayment plans is taxed as income. Lawmakers should address this flaw with income-based repayment, Delisle said.

Trump’s plan for public-service loan forgiveness

The Trump administration’s first budget proposes to curtail the program and estimates that will save $27 billion over the next decade.

The administration wants to end public-service loan forgiveness for federal loans issued July 1, 2018, or later, except those provided to borrowers to finish their current course of study. To be sure, the budget is a wish list, and Congress sets the spending priorities for the federal government.

Trump’s budget may have had the unintended effect of making public-service loan forgiveness more popular with borrowers.

“The budget proposal has raised awareness about public-service loan forgiveness. Borrowers realize that Congress will probably not retroactively take away that benefit, so they want it while it is still available,” said Aaron Taylor, executive director of the AccessLex Center for Legal Education Excellence.

[Source”GSmerena”]