Making India the skill capital of the world is one of the visions of Prime Minister Narendra Modi. While this will be a journey, the Union Budget 2015 does provide an opportunity for the government to bring to the forefront policies and initiatives that will be undertaken to achieve the vision.

A Deloitte study has recognised the Indian education sector as a ‘sunrise sector’ for investments. This is because the sector offers huge potential to investors in the regulated as well as non-regulated markets. The education market in India, which is at present valued around $150 billion, is headed for a major leap forward in the years to come.

As a percentage of GDP, expenditure on education has gone up from 2.9% in 2008-09 to approximately 3.4% in 2014-15. Compare this with the Kothari Commission (set up in 1964-65) and National Education Policy recommendation suggestion of allocating 6 percent of GDP towards education.

Statistics reveal that the allocation to the education sector received a 17 percent jump for fiscal year 2013-14 and approximately 12.5 percent for fiscal year 2014-15. However, it is still inadequate considering the sectoral requirement.

Thus, it is ironical to note that though the outlay of 6 percent of GDP was recommended almost 50 years ago, we are still far from reaching the mark in view of the present outlay not crossing even 4 percent of GDP.

The need of the hour is an increase in public expenditure on education along with incentivising the sector for private investment. A sound and efficient education system combined with growth and opportunities in the Indian economy will enable restricting flight of intellectual capital. There is a need to substantially add quality institutions, lest Indian students will have to look overseas for securing the desired level of education.

In the above background, some of the key expectations of the Education sector from the forthcoming budget are summarised below:

Encouraging private investment in the sector:

While significant operators in primary and secondary education sector operate on ‘not for profit’ basis, this aspect has impact and creates challenges in creating further infrastructure in the sector. In order to encourage investment in the sector, the government may contemplate encouraging private investment in this area along with devising mechanism wherein the investor is entitled to an agreed share of return on investment – akin to what has been prescribed for certain infrastructure projects like the power sector.

Encouraging education tourism:

Education tourism could be the next opportunity for India. Policies could be formulated that focus in this direction. India can well be seen as being intellectual capital of the world.

Affordable education loan/ finance facility:

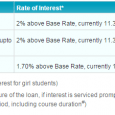

The government should recognise the need for facilitating affordable education loan/ finance facility by setting up institutions / education finance corporations that provide easy finance at concessional rates. Schemes could be devised to extend credit facilities for higher education without surety / indemnity by the government, repayable upon securing of job by the student.

Incentives for enrollment to skill development courses:

Enrollment for skill development courses should be eligible for additional deductions in computing taxable income.

Policy Initiatives

The extant foreign direct investment policy and the regulations governing education system need to be aligned to generate opportunities and encourage foreign capital and improve infrastructure in education sector.

Incentive towards staff training and development:

Tax incentives/ relief could be extended to universities / institutions that incur expenditure towards staff training and development.

Deduction towards tuition fees:

Considering the inflation and the rising cost of education, taxpayers should be entitled to a deduction of an adequate sum against gross total income for fees paid to a higher educational institution recognised by the government. This will ease the hardship of common man.

Currently, the deduction towards tuition fees to any university or college towards full time education of any two children is available as a part of aggregate deduction under section 80C which is presently capped at Rs. 1,50,000.

There is a need to consider either an increase in the amount of deduction permissible (where it continues to be part of aggregate deduction under section 80C) or providing for deduction towards tuition fees as a separate deduction per se.

To conclude, a strong higher education system is imperative for the development of an economy and it directly influences the quality of manpower. A skilled workforce grants leverage to an economy and considering the focus of the government on ‘Make in India’ campaign, due weightage needs to be given for development and improvement of skilled workforce.

The underlying expectation from the upcoming budget can simply be said to revolve around 3 As for education: Available, Accessible and Affordable. Key policy reforms and sound policy initiatives to stimulate growth and sector-specific reforms for the education sector are in anticipation.

[Source:- Firstpost]