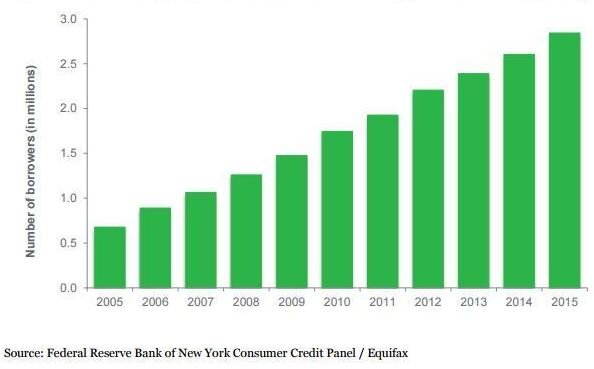

Student loan debt is most often associated with younger borrowers. But last year, the Consumer Finance Protection Bureau (CFPB) found a surprising statistic. The number of American consumers ages 60 and older with student loan debt quadrupled between 2005 and 2015, jumping from 700,000 to 2.8 million.

The cost of college has skyrocketed in recent years, and more Baby Boomers are deciding to help out. A majority of older borrowers with student loan debt are funding their child or grandchild’s education. (A minority are funding their own or their spouse’s education.)

According to the CFPB, older borrowers typically help out in two ways:

- Taking out a private or federal student loan in their name and gifting it to a child/grandchild

- Acting as co-signer on a child/grandchild’s loan

Before you take out a student loan…

You have plenty of alternatives to taking out a student loan or acting as co-signer. You can start by checking out the U.S. Department of Education’s College Scorecard. Users can compare prospective schools by cost, graduation rate, and salary after graduation.

Once you and your family member have selected possible schools, do your homework (no pun intended). Speak with a prospective school’s financial aid counselors. And gather as much information as you can about financing strategies. Here’s just a few of the options available to parents/grandparents of students:

- Scholarships

- 529 plans

- Coverdell Education Savings Account (ESA)

- Paying after graduation

Scholarships

There is such a wide variety of scholarships and grants that it’s difficult to keep track of them all.

Fastweb.com offers a free scholarship finding service for prospective borrowers. Both students and parents of students can search for scholarships. Be sure to fill in as many details as possible — you’ll be able to find the widest variety of options.

Parents and grandparents should inform prospective students of their work and education history and any military service. There may be a few hidden, legacy, scholarships available as a result of your background.

529 Plans

A 529 plan is a special savings plan designed to help parents/grandparents save for education expenses. There are two types of 529 plans: savings and prepaid plans.

529 savings plans act much like a 401(K) or Roth IRA. Contributions earn interest tax-free. Withdrawals are also tax-free, so long as students use the funds for qualified expenses. (Qualified expenses include tuition, room and board, and other education-based costs.)

529 prepaid plans are less popular than saving plans. Only 33 states (and the District of Columbia) still offer prepaid plans. It’s in the name — prepaid plans let parents pay for tuition in advance, and cash in later. And like savings plans, contributions grow tax-free.

But borrowers can only use prepaid funds for tuition and fees for in-state college tuition. There is a private college 529 prepaid plan option, but those only apply to member colleges, schools that participate in the program. Room and board expenses will still come out of pocket.

Note: Grandparents may have a more difficult time using a 529 plan than parents will. Funds distributed from a 529 account count as income toward a student. That can hurt eligibility for federal student aid.

Funds from a grandparent-owned 529 may reduce eligibility by half. Funds from a parent-owned 529 can reduce eligibility by as much as 5.64%. If you’re a grandparent, you may want to transfer ownership of your 529 to a parent instead.

Click here for more information on 529 savings plans.

Coverdell Education Savings Account (ESA)

A Coverdell ESA is a tax-deferred trust designed to help meet education expenses. Unlike 529 plans, contributions are tax-deferred. The beneficiary will pay taxes when they withdraw funds.

ESAs offer more freedom in spending options than 529s. Like other trusts, funds will become available when beneficiaries reach a specified age. They can then use the money to meet any expense they want.

ESAs come with narrow contribution limits — the most anyone can contribute is $2,000 a year. And to contribute, you must have a gross income of less than $100,000 ($200,000 if married and filing jointly).

Note: As with 529 plans, contributions from grandparents may count as income toward a student. That can hurt financial aid eligibility.

Paying after graduation

This strategy is simple: Help your child/grandchild repay their student loans. You’ll be offering the same amount of help, but later instead of sooner. Assisting in this way can also help your child/grandchild build credit.

If you assist with loans after graduation, your child/grandchild won’t have to worry about financial aid eligibility. And if you keep yearly payments under $14,000, the IRS won’t consider it a taxable gift. ($28,000 for married couples.)

If you’re struggling to repay a student loan

Whether you’re struggling to repay a loan in your name or a loan you’ve co-signed, don’t lose hope. There are still strategies you can take to streamline your debt.

Loan consolidation

Private loan organizations are not allowed to garnish your Social Security payments. But if you default on a federal student loan, your Social Security may be garnished.

If you have trouble repaying a federal student loan, you may be able to apply for an income-driven repayment plan (IDR). IDR plans allow borrowers to have monthly payments recalculated according to available income.

To qualify for an IDR plan, parents and grandparents have to apply for a Direct Consolidation Loan. Only federal student loans are eligible for direct consolidation and IDR plans.

IDR plans offer monthly payments equal to either:

- 20% of a borrower’s discretionary income

- The amount paid on a repayment plan with a fixed payment over 12 years

For those who have taken out private student loans, you may want to consider student loan consolidation.

Rehabilitating a federal student loan default

This does not apply to private student loans.

Borrowers who have defaulted on a federal student loan can have their default erased. The rehabilitation process is simple:

Make nine on-time, consecutive payments to a specified debt collector. Afterward, your loan will revert to a traditional lender, and you’ll be eligible to enroll in an IDR plan.

Remember, taking on debt later in life can be risky

Younger borrowers expect to enjoy income growth over the course of their career. Older borrowers most often experience a decrease in overall income and income variety. For a majority of retirees, Social Security is their only source of regular income.

Older borrowers also tend to carry additional debts, including mortgages and auto loans. If retirees default on a federal student loan, their Social Security may be garnished.

Still, student loan debt is the fastest growing type of household debt. And parents and grandparents still want to help so students don’t have to graduate under a mountain of debt. Fortunately, a student loan isn’t your only option for helping a family member further his or her education.There’s many way you can help your child/grandchild, without affecting your retirement.

source:_bankrate.c